The current state of Britain’s democracy and economy has become a pressing concern for many. With rising disillusionment among the populace and significant economic challenges, the insights of experts like Martin Wolf, Paul Wallis, and Mariana Mazzucato shed light on the underlying issues. This blog explores their perspectives on the chaos enveloping Britain and the potential pathways to recovery.

The Emergence of Chaos Over Autocracy

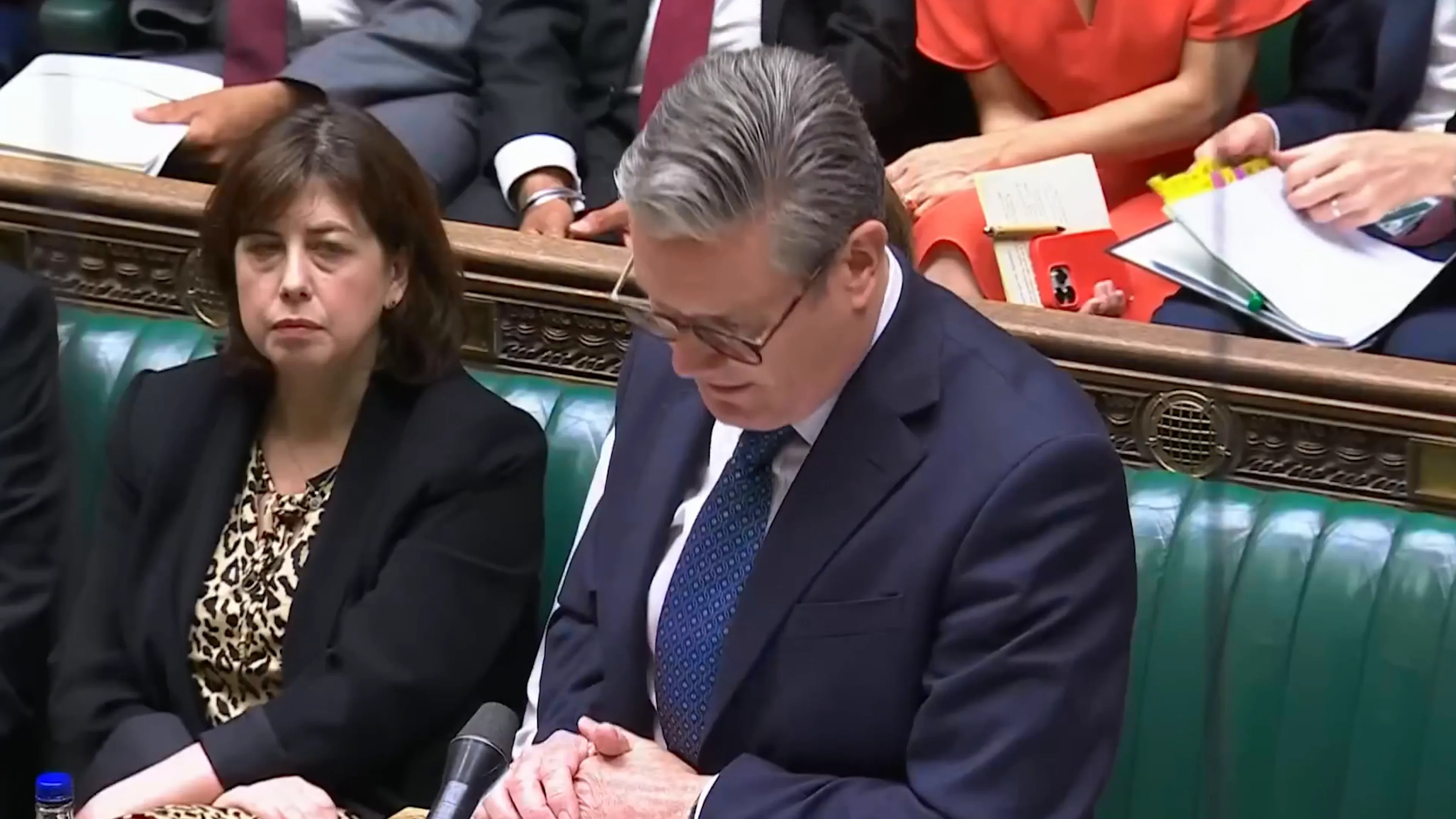

As we delve into the current political landscape, one of the most alarming observations made by economist Martin Wolf is that the real worry in Britain is not autocracy but chaos. This chaos arises when governments fail to deliver better living standards and a more secure future for their citizens.

When people lose faith in their governments, they often perceive all politicians as corrupt or incompetent. This disillusionment leads to a dangerous situation where the populace begins to search for saviors, asking, “Who’s going to save us from this?” This sentiment is particularly pronounced in a country that has experienced significant economic turmoil.

The Profound Impact of Brexit

Brexit has undeniably reshaped the economic landscape of Britain. The foreign exchange markets have reacted, indicating that the economy has been devalued significantly. Wolf notes that the higher growth rates enjoyed before the 2008 recession came at a terrible cost, leading to the worst economic downturn since World War II.

He emphasizes that economic systems are not deterministic; they are outcomes of numerous decisions made over time. The decisions regarding how to govern and organize both the public and private sectors play a crucial role in shaping economic outcomes. Unfortunately, the current ecosystem between these sectors is problematic.

Challenges of Leadership and Economic Management

One of the most pressing issues is the failure of leadership. Wolf expresses concern that without addressing the economic problems, the political landscape may become even more dangerous in the next decade. The damage inflicted by the populist Brexit campaign has left the country in a precarious position, with no apparent way out of its economic problems.

To navigate these challenges, there is a pressing need to resolve the relationship with Europe favorably. Wolf argues that while Brexit cannot be reversed, establishing a better relationship could reduce uncertainty for businesses, fostering investment and creating a self-reinforcing momentum.

Taxation and Investment: Key Strategies for Recovery

Taxation plays a crucial role in encouraging investment. Wolf highlights the importance of maintaining tax incentives like the “super deduction,” which allows businesses to write off investment expenses. While taxing corporate profits may seem politically appealing, it often results in lower investment levels.

Additionally, there is a significant need for investment in scientific and innovative capacity, particularly within universities and leading companies. Public-private partnerships could be instrumental in nurturing this growth, especially in sectors like life sciences.

The Importance of Regional Empowerment

Another critical area of focus is the “leveling up” agenda. Wolf argues for the need to allocate resources and empower regional and sub-regional governments. The over-centralization of decision-making in London has contributed to many of the economic problems faced across the country.

Encouraging immigration of skilled individuals is also essential for fostering growth. The need for new talent is apparent, and the current immigration policies have shown some positive results in this regard.

Pension and Savings Reform: A Necessity

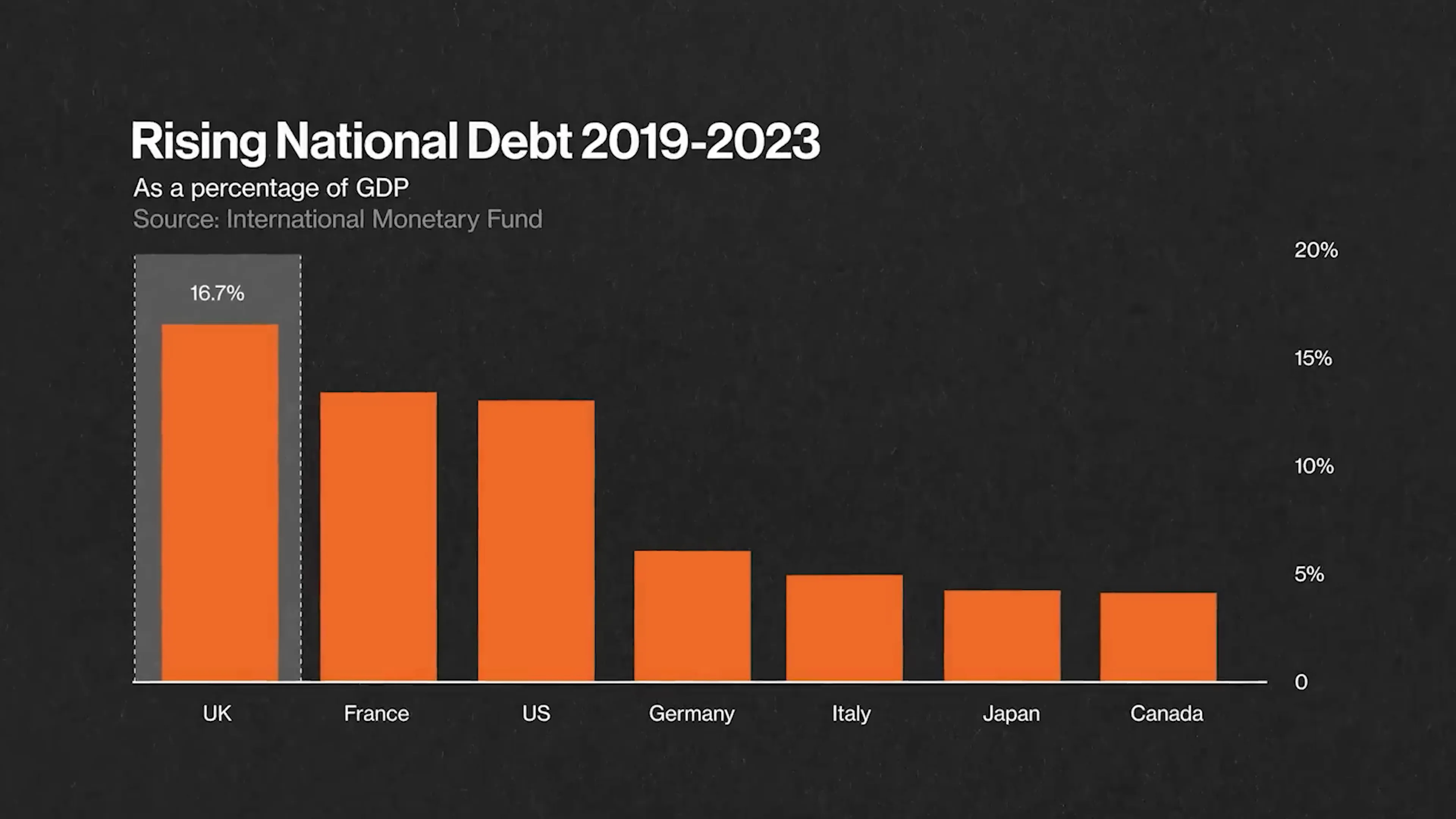

Reforming pensions and savings is another vital step towards economic recovery. The UK currently holds the lowest savings rate in the Western world. Many defined benefit pensions are locked up in bond funds, failing to invest in new businesses or equities, which is counterproductive.

The contribution rates for pensions are also too low, hindering individuals from achieving a decent retirement income. These systemic issues need urgent attention to bolster the national savings rate and ensure a more secure financial future for citizens.

The Interconnectedness of Democracy and Economics

As mentioned by Wolf, democracy relies on a functioning economic system, which is currently in crisis. Paul Wallis echoes this sentiment, attributing the economic decline to poor political decisions, particularly those stemming from Brexit.

Wallis compares the economic performance of the UK before and after 2007, noting a stark contrast in growth rates. The economy grew by nearly three percent annually in the fifteen years leading up to 2007, but has since stagnated at just over one percent.

Systemic Failures and the Need for a New Approach

Mariana Mazzucato highlights the broader systemic failures within the decision-making processes of both public and private sectors. The focus on maximizing shareholder value has led to a parasitic relationship between these sectors, where decision-making is reactive rather than proactive.

With over six trillion dollars spent on share buybacks by large corporations, the emphasis has shifted away from sustainable economic growth. The relationship between public and private sectors is characterized by a lack of collaboration, resulting in an ultra-financialized environment.

The Role of Strategic Vision in Governance

The current political climate is marked by a lack of strategic, visionary governance. This issue is not due to incompetence among government officials but rather a pervasive fear of ideological backlash. Mistakes are met with harsh criticism, stifling the capacity for innovation and proactive governance.

Governments need to set clear challenges and utilize every available tool to catalyze collective intelligence across the economy. The capability to innovate and adapt has been eroded over years of outsourcing and reactive governance.

A Crossroads: The Future of Britain

As Britain stands at a crossroads, the intertwined crises of democracy and economics call for more than just short-term fixes. Experts like Martin Wolf, Paul Wallis, and Mariana Mazzucato warn of the deeper challenges at play, raising critical questions about the nation’s future.

Will the country find the vision and leadership needed to secure its future? Or will continued mismanagement and ideological divides further entrench the chaos? The path forward requires collective effort, innovative thinking, and a commitment to long-term solutions.

For those interested in exploring this topic further, you can watch the full discussion featuring insights from Martin Wolf, Paul Wallis, and Mariana Mazzucato.

Your thoughts and engagement are crucial in this conversation. Join the discussion in the comments below, and let’s work towards a more informed and engaged society. Remember to stay informed and stay engaged!